b&o tax rate

The surcharge imposed on advance computer services was modified but still remains in place. B o tax rates.

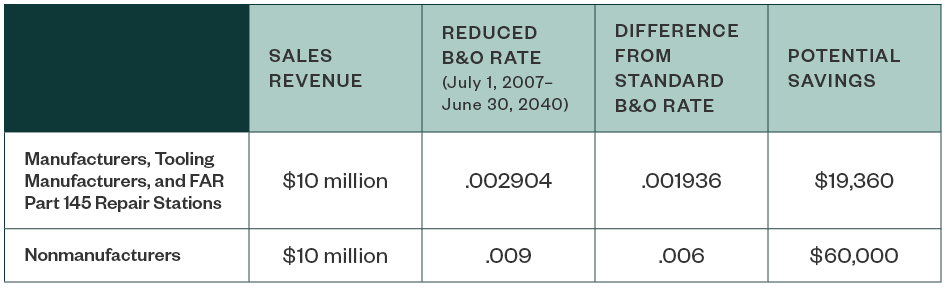

Washington Aerospace Tax Incentives

The model was updated in 2007 2012 and.

. November 12 1986 dear mr. If your business is printing and you are filing a local tax return for 2018 the tax rate you will pay is 000222 or222. Washington state doesnt have income tax like most states but business owners do need to.

Heres what the bo tax looks like for your. Look up a tax rate. As of january 1 2012 the business.

Most Washington businesses fall under the 15 gross receipts tax rate. BO is defined as a tax on the value of products the gross income of the business or the gross. V voter approved increase above statutory limit e rate higher.

The current gross receipts tax rate of 01496 percent applies to all gross receipts tax classifications. Rate increase for specified financial institutions. Multiple business classifications can be filed.

The relationship between the state BO tax and the local BO taxes is similar at least in concept to the sales tax. The Manufacturing BO tax rate is 0484 percent 000484 of your gross receipts. Legislation adopted in the 2003 session required the 45 cities with local BO taxes to adopt a city BO tax model ordinance.

The state does not exempt marketplace facilitators from collecting and remitting sales tax in addition to the BO. The gross receipts BO tax is primarily measured on gross proceeds of sales. Washington BO Tax Rates 175.

Beginning January 1 2020 HB 2167 if enacted would impose an additional 12 BO tax in. Not sure what a local BO tax is. The tax amount is based on the value of the manufactured products or by-products.

Please see the BO Tax Return form for a list of rates. See all City business tax rules. For retail businesses where the BO tax is based on gross receiptsincome the maximum tax rate may not exceed 02 of gross receipts or gross income unless approved by a simple majority.

Washington has a state. Any license fee or tax. The nexus determination for sales tax is similar to the BO.

Multiply the Total Taxable Amount by 0001. Contact the city directly for specific information or other business licenses or taxes that may apply. The square footage BO tax rate for 2022 is 02789046 2789 cents per taxable square foot per quarter or 11156185 112 per taxable square foot per year.

To learn more about the state BO tax visit the Washington State Department of Revenue. The tax amount is based on the value of the manufactured products or by-products. The Infamous BO Tax.

The Manufacturing BO tax rate is 0484 percent 000484 of your gross receipts. This rate is adjusted each. Called the Business.

Also there is a property tax of 260 for every 1000 of assets your business owns that is located in the state. Washingtons BO is an excise tax measured by the value of products gross proceeds of sales or gross income of a business with over 30 different classifications and associated tax rates. Nobody likes taxes but people really really hate the levy Washington imposes on businesses.

BO TAX RATES Based on Gross Receipts Extracting 0017 Manufacturing 0017 Retailing 0017 Wholesaling 0017 Services and other activities 0044 BO TAX SCHEDULE Tax returns must. BO tax rate increases and surcharges. In Washington the gross receipts tax is called the business and occupation BO tax.

The new law replaces this surcharge with a BO tax rate increase on these services. You must file your Seattle taxes separately from your state taxes. Washington State BO tax is based on the gross income from business activities.

As of January 1 2012 the Business Occupation BO Tax Rates have changed. Washington BO Tax Rates 2021. Tax Rate Line 12 - The BO tax rate for the City is 110 of 1.

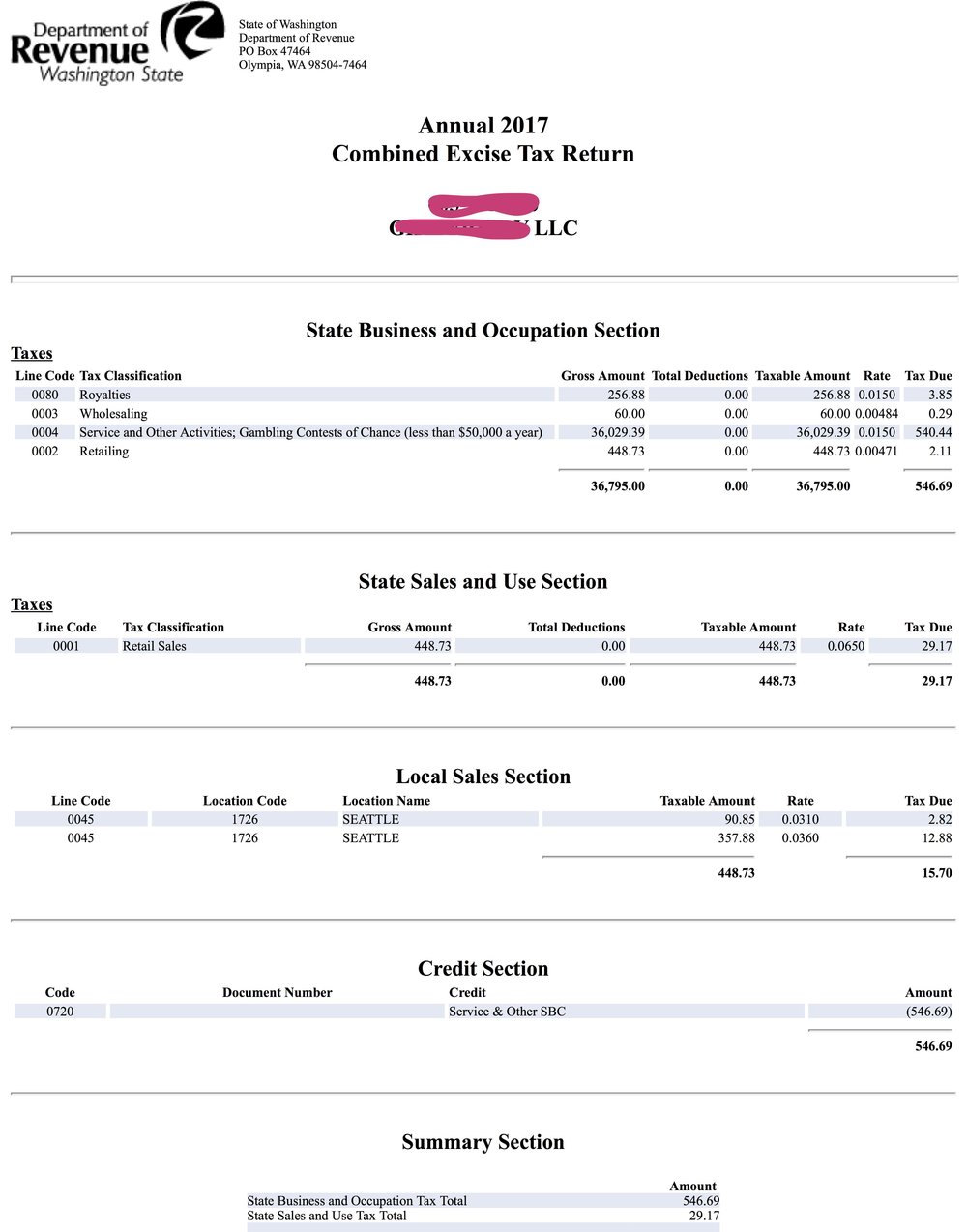

When paying the B O tax to the Department of Revenue you declare your income in different categories. Have a local BO tax. Be careful in calculating the tax owed.

Wa B O Tax Form Fill Online Printable Fillable Blank Pdffiller

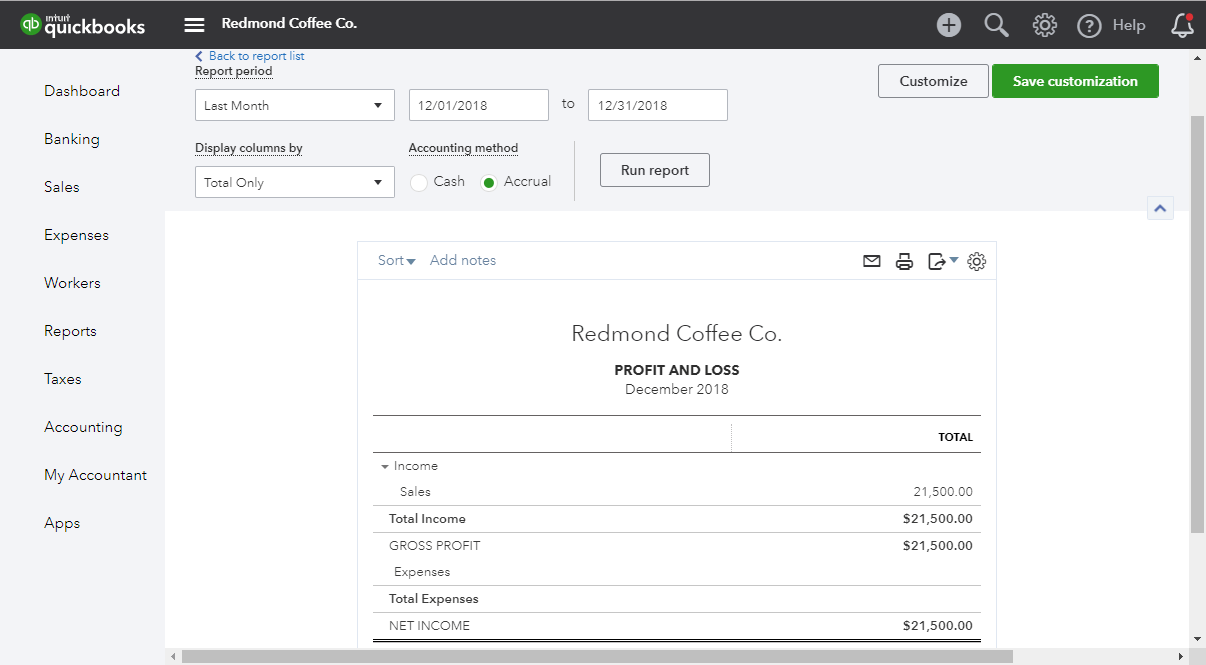

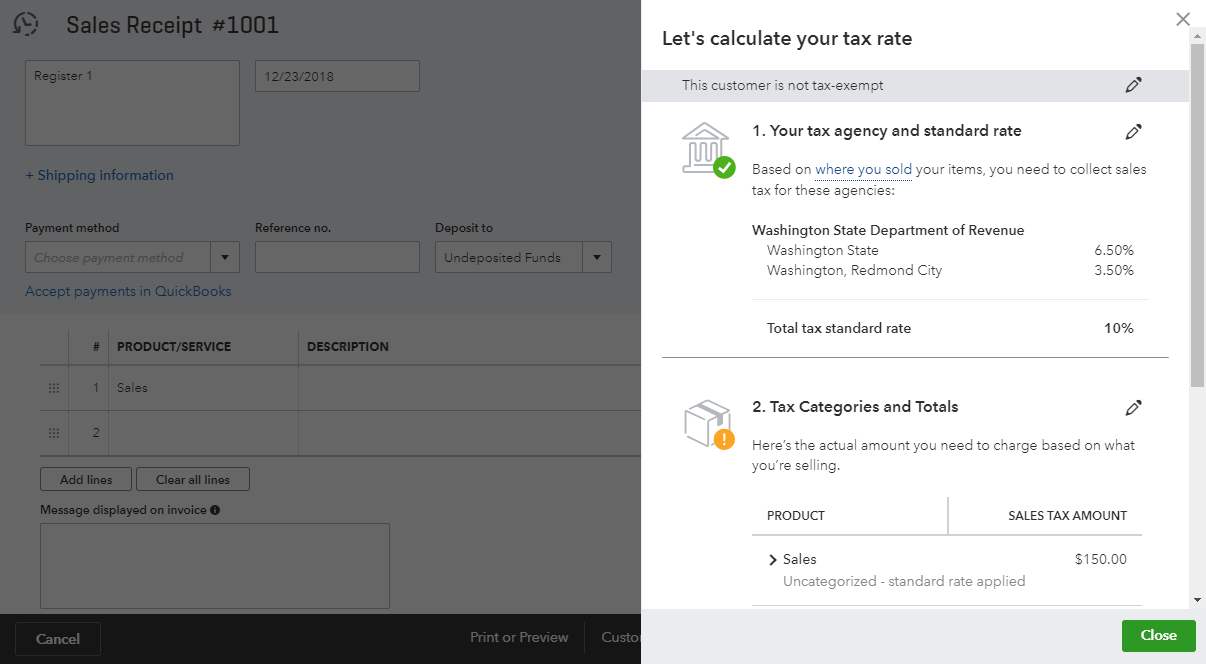

How To Record Washington State Sales Tax In Quickbooks Online Evergreen Small Business

City Of Tacoma Tax License Pages 1 4 Flip Pdf Download Fliphtml5

Does Your State Have A Gross Receipts Tax State Gross Receipts Taxes

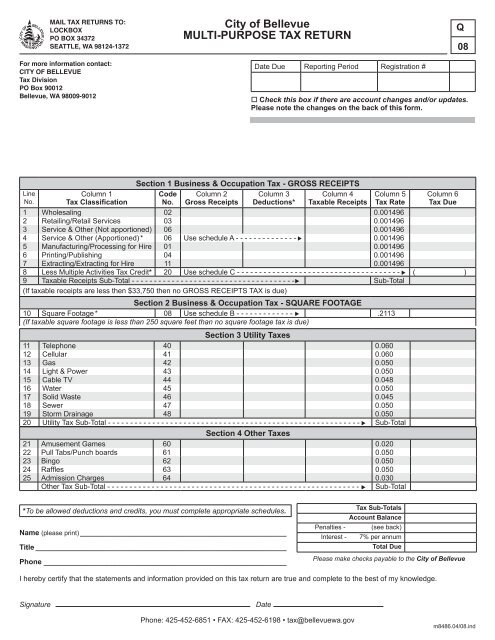

Quarterly Multi Purpose Tax Return City Of Bellevue

The Washington B O Tax Nexus Traps For The Unwary Taxpayer Deloitte Us

Business Occupation Tax Bainbridge Island Wa Official Website

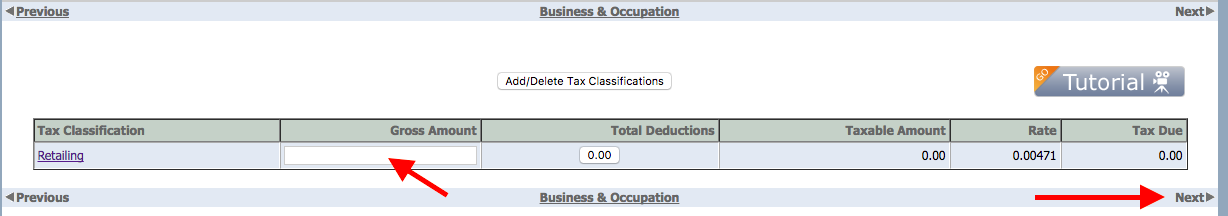

Taxjar Autofilers How To File Washington Business And Occupation Tax Taxjar

Business And Occupation Tax City Of Renton

City B O Tax Model Ordinance Update A Summary Of City B O Tax Authority Required Updates To The Model Ordinance October 2007 Association Of Washington Ppt Download

Washington Updates Requirements For Investment Management Companies To Qualify For Reduced B O Tax Rate Deloitte Us

Business Occupation Tax Bainbridge Island Wa Official Website

B O Tax Blog Seattle Business Apothecary Resource Center For Self Employed Women

Double Duty How Startups And Small Businesses Could Be Hit Twice Under Seattle S New Income Tax Geekwire

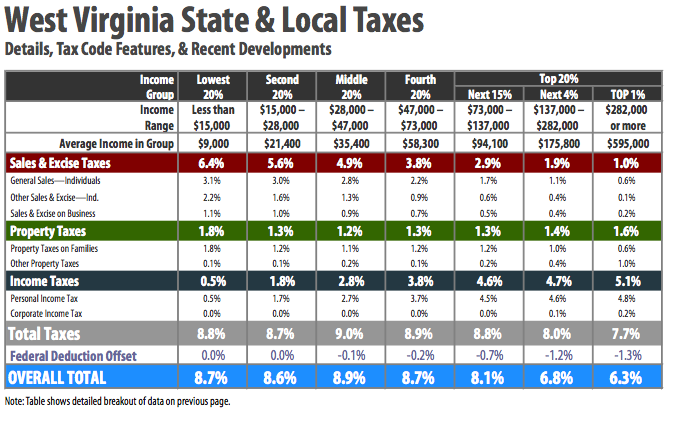

The Charleston Tax Shift Is It Worth It West Virginia Center On Budget Policy

City S Proposed B O Tax Hike Will Hurt Business Economy Kent Reporter

Washington Updates Requirements For Investment Management Companies To Qualify For Reduced B O Tax Rate Deloitte Us

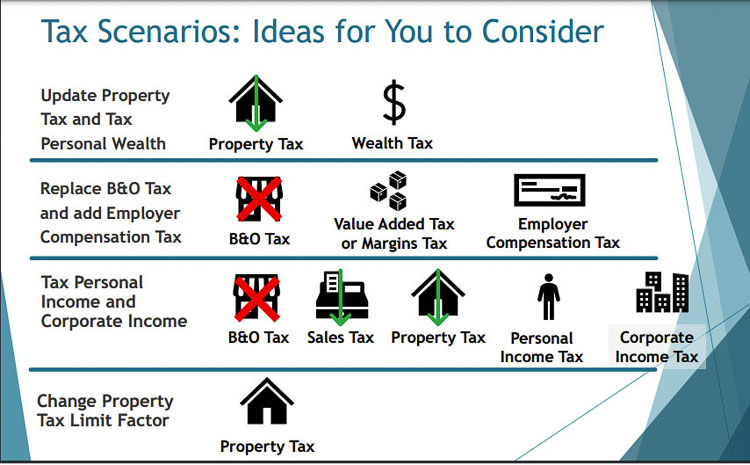

State Tax Structure Workgroup Seeks Input For Possible Changes To Washington Tax System Clarkcountytoday Com

How To Record Washington State Sales Tax In Quickbooks Online Evergreen Small Business